Simple and Clear Contracts: how to simplify the process of writing Insurance contracts

Mariangela Mancini

IVASS, with the letter to the market of March 14th 2018, has finally established the road map to reach a simplification of the insurance contract.

The letter to the market is the last of many measures in order to reorganize contractual clauses: these are not always clear and are unambiguous in relation to guarantees, exclusions, compensation and indemnities.

Specifically, IVASS has established both the timing of implementation, setting the deadline at the beginning of 2019, and the methods of implementation, advising the use of the guidelines “Simple and Clear Contracts” by category Associations under the coordination of ANIA.

From the ANIA guidelines, we define the general principles concerning greater intelligibility, clarity and coherency of the insurance contract:

- intelligibility means the incentive of a form of communication that is more colloquial and close to the level of preparation and knowledge of the client

- clarity means the intention to make the insurance contract more consumer-friendly through the introduction of the contract in electronic format, the use of graphical surveys for some very important contractual clauses (guarantees, exclusions, conditions, taxes etc.) and the insertion of explanatory boxes and consultation boxes aimed at clarifying the criteria for assessing the damage, determining the compensation and the relative liquidation;

- consistency is achieved with a “single” contractual body through the amalgamation of general and special conditions in order to avoid confusion and confliction with clauses of the contract.

The guidelines of ANIA qualify as a “strategy” document in which are indicated the best practices to adopt in order to make the insured aware of the guarantees and exclusions he is buying, in this way the Companies are invested with a new accountability aimed at making the insurance contract more intelligible, clear and coherent.

With this in mind, the new regulations on contracts present the opportunity for the Company to rethink the entire process of defining contracts with a view to good management aimed at improving efficiency and organizing the definition of the steps that lead to the publication of contracts.

The definition of a contract is a process that involves different actors, with different logics, called to define the section of their competence and at the same time share the work done in a co-working perspective.

The resulting data are often unsatisfactory: unclear communication and lack of coordination between one or more actors involved cause confusion, reworking, incorrect or incomplete content, inconsistencies in texts, versioning misalignment, duplication of activities, and poor quality and risks of inconsistency in parts of the contract.

The legislation represents a good starting point for the definition of a framework, a set of rules and procedures where each paragraph of the insurance contract finds an “ordinary” management and is defined in advance.

Consider, for example, a process of definition of the insurance contract similar to a process of drafting the financial statements where each owner is accountable in his area of expertise and where his contribution is set within a well-established decision-making and operational process, with clear and well defined deadlines.

Clustering of information, identification of process owners, definition of information transfer procedures can be the drivers for the definition of a process of drafting the insurance contract aimed at obtaining clarity and simplicity in writing up the contract.

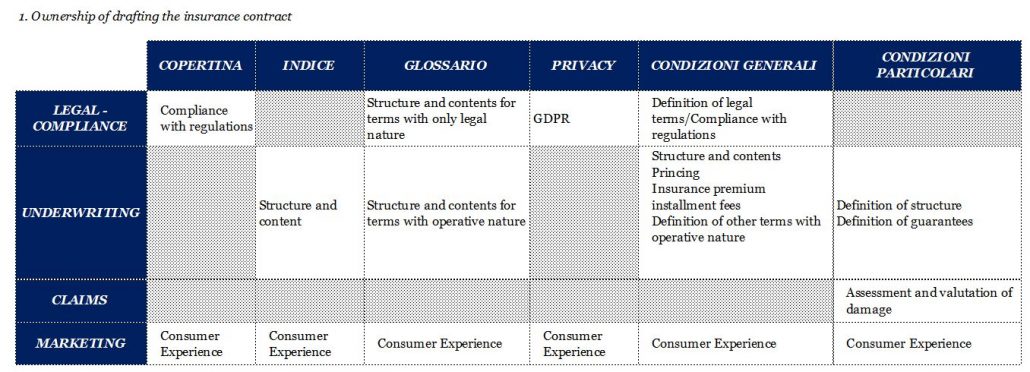

Exemplifying. the different ownerships can been represent as synthesized here following.

The mapping of the process could also be carried out through the design and development of a tool that allows the owners to feel part of an “organized” procedure, by expanding the different milestones related to the drafting of the contract, and by being active subjects of the definition, writing, verification and validation of the contractual paragraphs, opening in case of necessity tickets aimed at solving “sudden” problems and requesting the contribution of the owners who have the greatest mastery of the emergence of the issue.Certainly, a process supported by a computerized workflow system would bring many advantages in terms of effectiveness and efficiency, thereby improving the quality of the structure and clauses of the contract. There is greater awareness around roles and responsibilities, avoiding bottlenecks and gray areas in the definition of the contract. Furthermore, the organizational advantages linked to the repository function must also be considered: having always available the latest version of the insurance contract makes efficient the process of ordinary updating and variation of the contractual clauses and of all the additional information contained in the contract.In conclusion, to satisfy the new regulatory constraint of clarity and simplicity of contracts, it is mandatory to obtain the “clarity” and “simplicity” of the decision-making process that lies behind the drafting of a contract: in this perspective the use of a process tool can be defined as the hot topic of this new phase of renewal in order to overcome the current and future challenges of the market, oriented towards an increasingly greater complexity of insurance products, above all in financial components and in digital services that are more requested by clients.

Vai alla versione italiana

Condividi questo articolo

Financial Industry Transitions to T+1 Settlement Cycle. Is Europe ready?

Tokenization: Reshaping Financial Markets and creating new asset classes

Is the EU Banking Sector Ready for Fit-for-55? Insights from the Recent EBA Climate Risk Reporting Template