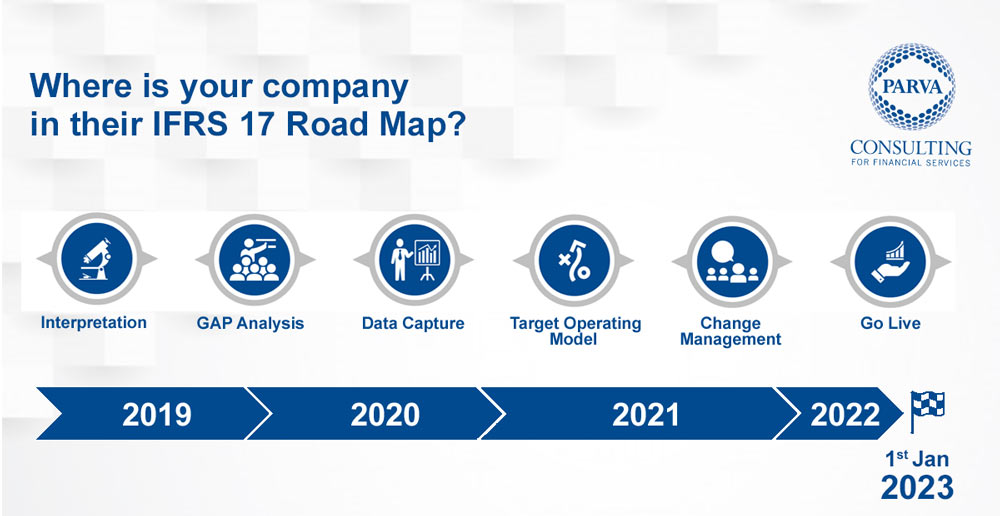

Where is your company in their IFRS 17 Road Map?

By Adam Nelson

IFRS 17 aims to build on its predecessor, IFRS 4, to provide a more complete and granular way of accounting for insurance contracts. While currently undergoing an IFRS 17 implementation project for a large Irish insurer, Parva has found that key market leaders are already between the Target Operating Model (TOM) and Change Management

We identified 6 steps to achieve the objective:

- Interpretation of the new standard and understanding of its implications across key business functions

- GAP Analysis of your current operating models and planned changes to ensure appropriate controls are in place

- Data Capture of accurate and current data is essential for testing and for historical comparison after the go live date

- Target Operating Model must be outlined, and a detailed project roadmap set in place for achieving this strategic goal

- Change Management across all key functions such as IT, Actuarial, & Finance as well as trainings must be managed to ensure efficiencies

- Go Live by the implementation date and continue to monitor the systems to ensure no issues arise

From our experience running IFRS 17 projects we have found that the data capture stage can be challenging as IFRS 17 requires an immense amount of data and some legacy systems may not contain data with the granularity required. Further to this firms now have the considerable task of implementing this new accounting standard while also continuing with business as usual (BAU). In our experience firms have often underestimated the time and scale of IFRS 17 projects.

Parva differentiates itself as a niche consultancy to our financial services clients in two important ways. First is our European DNA. With offices in Luxembourg, Dublin and Milan, our project engagements span most of the leading financial centres in Europe. Because your business, regulators, company leadership and most importantly your customers are international, you will value a wider pan-European lens on your challenges and growth ambitions.

Furthermore, we believe project implementation is firm-specific and requires flexibility. So our approach is resolutely ‘hands-on’. As a niche consultancy we identify, design and implement tailored solutions working with our clients We approach each challenge anew and with the agility to meet your changing needs. Our people combine industry knowledge of your business with the experience of delivering real change. For us, change is granular, non-standard and particular to you. in their implementation plan.

IFRS 17 is a large-scale change management project that requires key stakeholder management across various groups.

Share this article:

Case Study – Digital transformation project for an international Loan & Leasing company

DORA and contractual arrangements

RAIF and Luxembourg market