A new Macroprudential Approach for Investment Funds in Ireland: Insights for Potential Impacted Parties – Discussion Paper 11 (DP11)

by Luca Massari & Barbara Leydon

CBI discussion paper 2023

Background and overview

In July 2023, the Central Bank of Ireland (CBI) released a discussion paper, DP11, addressing the need for a new macroprudential framework in Ireland’s investment funds sector. Despite its growing importance in the global financial system, the sector lacks sufficient regulation to prevent the amplification of financial shocks, as evidenced by events like the COVID-19 crisis and disruptions in the Gilt market. The paper aims to initiate a conversation on adjusting the existing regulatory structure to enhance stability and mitigate systemic risks in times of stress.

Systemic Risk from Investment Funds

The Central Bank believes that “frictions” exist in how investment funds facilitate financing. These frictions include:

- Coordination issues, where each investor makes rational decisions that collectively lead to sub-optimal outcomes.

- Informational gaps, arising from imperfect information among economic participants.

- Incentive misalignments, where agents’ motivations do not fully align with those they represent.

These frictions can result in excessive systemic risk, often driven by the collective actions of investment funds, as seen during COVID-19. Additionally, The Discussion Paper highlights two primary vulnerabilities in investment funds: liquidity mismatches and leverage. These vulnerabilities can interact, especially for highly leveraged funds, potentially triggering asset sales and feedback spirals during crises.

A Macroprudential policy would aim to enhance financial stability by preventing excessive vulnerabilities and minimizing the sector’s impact on the broader financial system during adverse shocks. The policy would focus on fund cohorts, operate proactively, and target systemic risk sources.

What practical implications might these macroprudential policies have?

The Discussion Paper’s intention is not to finalise specific tools but to assess their potential benefits and consider the need for new ones. Macroprudential actions might involve repurposing current regulations or creating new, specialized tools tailored to the investment funds sector.

- Liquidity Management: These measures aim to reduce the negative impact of liquidity mismatches, especially during stressful periods.

Strategies include aligning asset liquidity with redemption frequency and creating liquidity buffers. Given the sector’s diversity, a tailored approach is favoured over a uniform solution, potentially involving new policies.- Impact: changing liquidity requirement, affect fund cashflow (less cashflow), fund documentations, governance, trading, less cashflow.

- Leverage Control: Macroprudential measures for leverage intend to prevent excessive borrowing and enhance fund resilience.

While implementing leverage limits is a suitable strategy, it presents operational challenges, such as preventing “leakage” through the establishment of new entities by funds.- Impact: adjusting trading strategies, possible realignment of existing investments.

- Addressing Correlation: Tools aimed at minimizing the correlation of fund cohorts with the broader financial system seek to limit spillovers that could affect other areas of finance.

Existing tools like concentration limits may be adapted, but they could impact market dynamics. Margining is an alternative, although its impact on liquidity risk is uncertain. The choice of correlation targeting tools depends on the specific risks posed by particular fund cohorts.- Impact: additional reporting requirements.

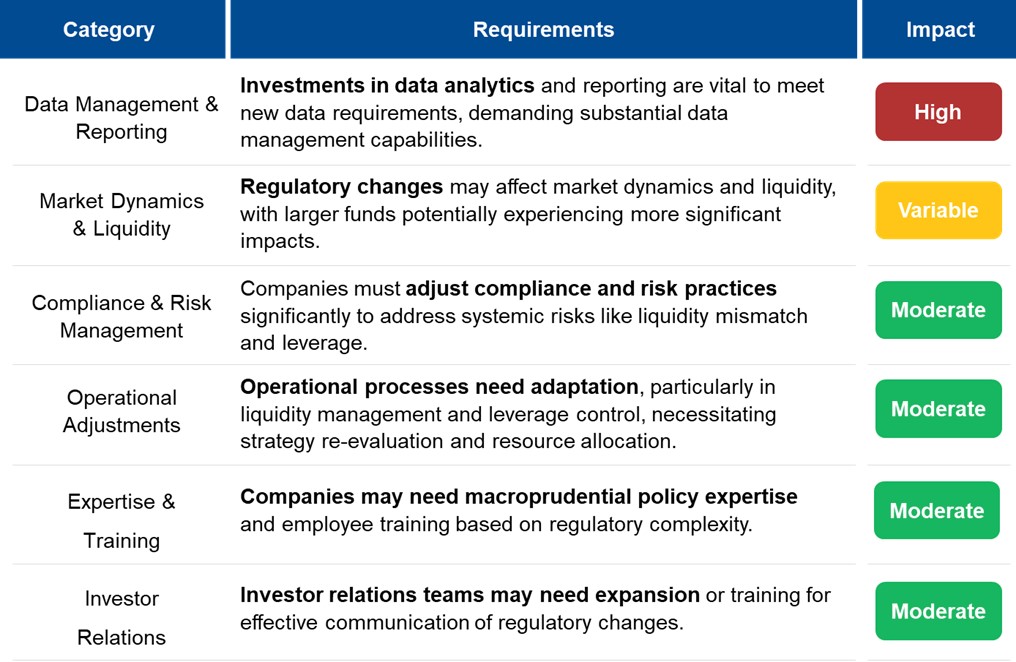

How and to what extent could this impact companies?

The potential impacts on companies in the investment funds sector can be categorized as follows:

Fund administrators may face new responsibilities, including implementing stricter controls on individual fund leverage and asset liquidity. They might need to conduct checks and tolerance-based controls on fund leveraging and liquidity across all administered funds. Reporting these measures to regulatory authorities like the CBI could be required.

Fund administrators may also need to update:

- operating procedures

- workflow processes

- NAV review checklists

- training to comply with new regulatory changes.

Investment managers and Fund managers will be mostly impacted with responsibility for redesigning and enforcing additional controls and updating governance policies & procedures.

Traders will need to amend trading limits & restrictions, strategies and possibly perform some portfolio realignment.

Clients also may need to be aware of new processes to apply Swing Pricing and Dilution Levies appropriately that may extend beyond existing funds ranges if these changes are finalised in the paper.

We would recommend Asset managers and their Service Providers to engage before the deadline of 15th November 2023 to ensure their voices are heard and to track the impacts of the new architecture proposed by the CBI.

What you need to consider as the CBI consultation progresses

We believe the overall proposal makes sense at a policy level to address deficiencies in the global financial system. There are a lot of open questions on the design of these tools and controls that will need to be considered as discussions move forward.

- How will the money-market tools interact with the existing money-market guidelines issued (such as fixed, minimum liquidity requirements for MMFs)?

- How will the proposals interact with other EU legislation, such as MiFID/MiFIR and the Short Selling Regulation, provide national (and EU) authorities with the powers to intervene in the event of crystallisation of risks to financial stability?

- How will co-ordination work across the sector in the event of emerging systemic risks?

- Who defines the systematic risks and what are the roles and responsibilities of each party?

- How will the system work across borders where Irish Funds are part of a wider ecosystem of structures like Fund of Funds and complex holding structures for Private Assets?

- How will design accommodate incomplete or unavailable information from outside Ireland and/or EU?

Source: https://www.centralbank.ie/publication/discussion-papers/discussion-paper-11-an-approach-to-macroprudential-policy-for-investment-funds