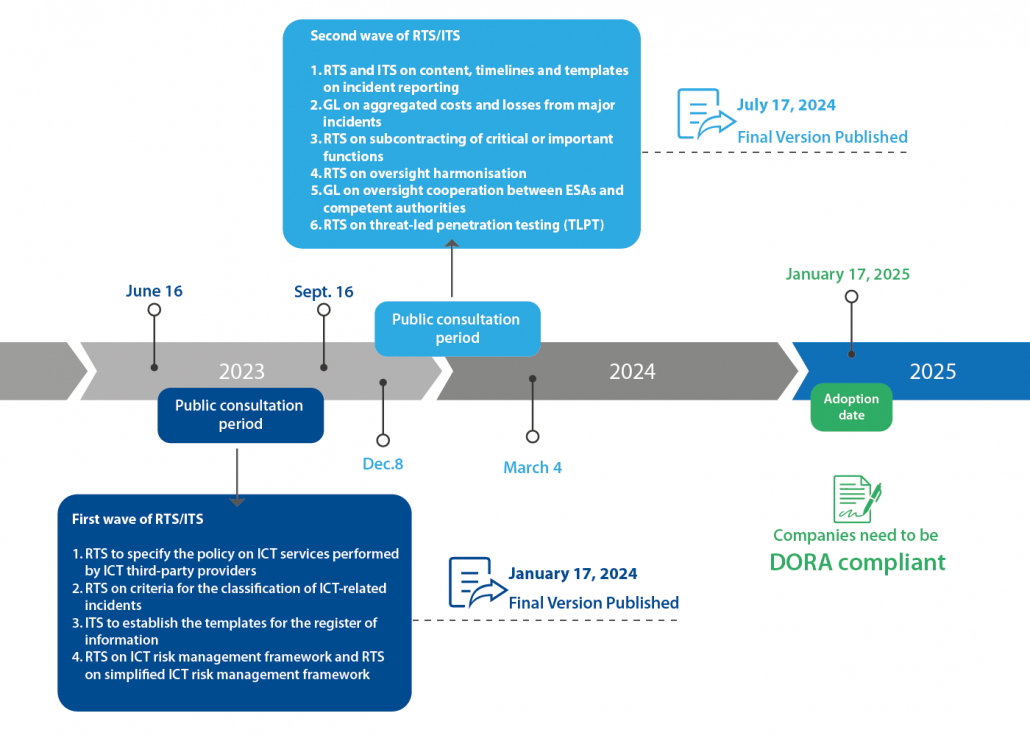

DORA: The digital operational resilience for the financial sector

Shaping Together a Resilient Digital Future

Welcome to DORA: the Digital Operational Resilience Act, designed to empower the financial sector with comprehensive guidelines and regulations to safeguard operations in the digital age.