Parva SpA P.Iva e C.F. 04747210963

MEMBER

ASSOCIATE

MEMBER

AWARDS

AWARDS

SUPPORTER

SUPPORTER

The rapid expansion of over the past decade has captured the attention of both governments and regulators.

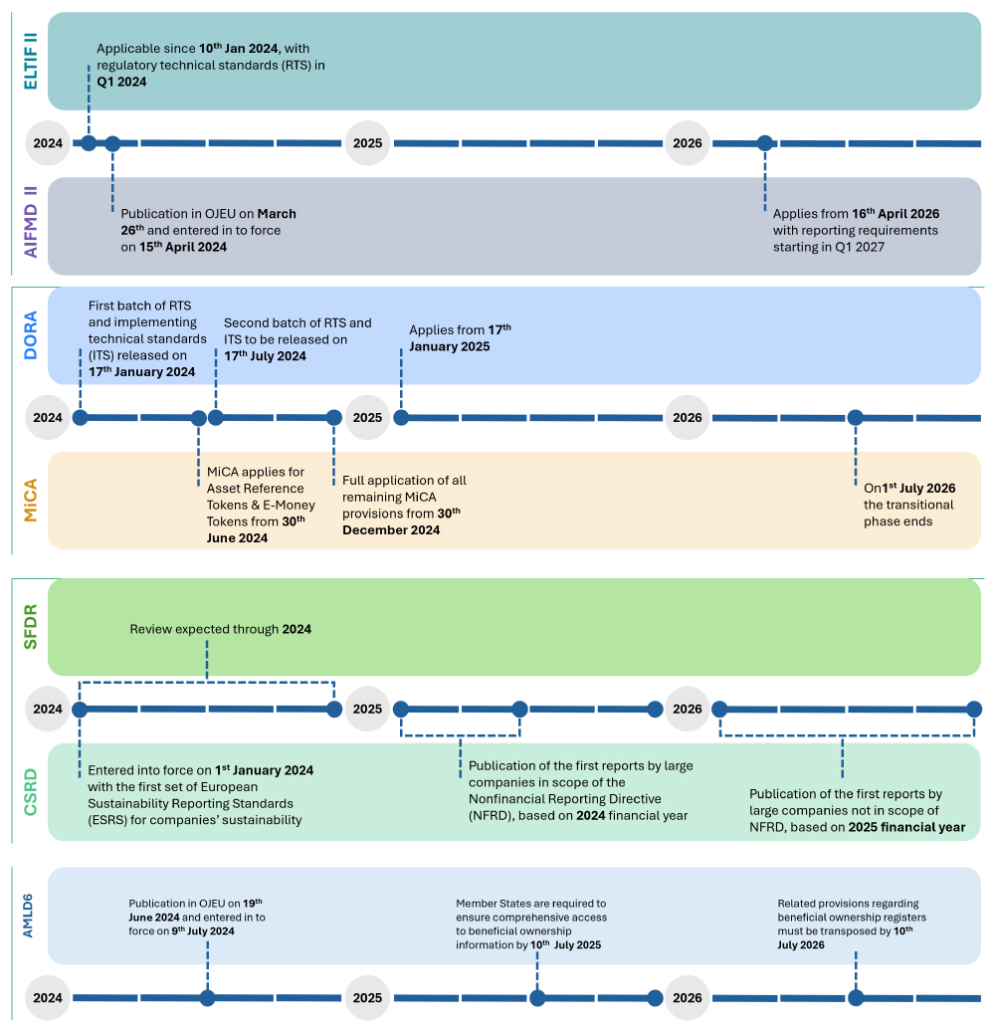

The regulatory landscape for private markets and private assets is set to undergo significant changes from 2024 to 2026. These forthcoming regulations aim to enhance transparency, sustainability, and operational resilience, aligning with broader EU initiatives to create a more robust and integrated financial system.

They bring specific requirements and changes that will impact private market participants, imposing strategic adjustments and thorough preparation to ensure compliance and capitalise on emerging opportunities.

It is expected that the sector’s level of supervisory scrutiny will intensify in 2024. The industry must make substantial investments to properly resource its risk and compliance functions, ensuring they have strong control frameworks and efficient operational processes.

Digital Operational Resilience Act (DORA) is a comprehensive EU legislative framework aimed at strengthening the digital operational resilience of the financial sector. It ensures that participants can withstand, respond to, and recover from ICT-related disruptions and threats. The regulation applies to financial entities and critical third-party service providers.

Markets in Crypto-Assets Regulation (MiCAR) establishes a harmonised regulatory framework for the crypto-assets market within the EU, aiming to protect investors, ensure financial stability, and foster innovation. The regulation becomes fully applicable on December 30, 2024.

European Long-Term Investment Fund (ELTIF) 2.0 aims to enhance the functionality and appeal of ELTIFs. The regulation, applicable since January 10, 2024, seeks to address the limitations of the original framework to facilitate increased investments into the real economy, supporting sustainable and inclusive growth across the EU. Existing ELTIFs compliant with the initial ELTIF 1.0 regulation and not raising additional capital automatically comply with the new regulation until January 11, 2029, providing a transition period for adjustment to the new standards.

Alternative Investment Fund Managers Directive (AIFMD) II revises Directive 2011/61/EU, enhancing the regulatory framework for Alternative Investment Fund Managers (AIFMs) within the EU. The updated directive aims to improve investor protection, market integrity, and financial stability by addressing issues identified since the original directive’s implementation.

The European Union continues to evolve its regulatory framework to combat money laundering and terrorist financing. The Sixth Anti-Money Laundering Directive (AMLD6) was published in the official journal on 19 June 2024, and it aims to repeal and replace AMLD4 and AMLD5, establishing a broader and robust Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) framework. Member states are required to transpose AMLD6 into their national legislation within three years, by 10 July 2027, allowing for a structured transition to new standards that address previously unregulated aspects of money laundering and terrorist financing risks.

Reinforced rules on beneficial ownership registers

Easier access to real estate registers for criminal investigations

Reinforced powers for FIUs

Emphasised importance of supervisory authorities

Strengthened cooperation between supervisors in the non-financial sector

Confirmed relevance of risk assessments

Sustainable finance regulations, including the Sustainable Finance Disclosure Regulation (SFDR) and the Corporate Sustainability Reporting Directive (CSRD), aim to enhance transparency, reliability, and comparability of sustainability disclosures. These regulations help investors make informed decisions and ensure companies are accountable for their social and environmental performance. The 2024 updates to SFDR and the amendments to CSRD reflect feedback from market players and significantly improve the current legal framework.

Expanded scope of applicability – The CSRD expands the scope to include all large companies and all com panies listed on EU-regulated markets, with the exception of listed micro-enterprises. This broadens the scope to include small and medium-sized (SMEs) that are publicly listed. Even smaller companies, if listed, must adhere to the new reporting standards, significantly increasing the number of participants required to report on sustainability matters.

Standardisation and comparabilit – The CSRD mandates the use of European Sustainability Reporting Standards (ESRS), developed by the European Financial Reporting Advisory Group (EFRAG) to ensure that sustainability information is reported consistently across companies, enhancing comparability.

Digitisation of reporting – Companies are required to prepare their sustainability reports in a digital, machine-readable format (XHTML), facilitating easier access, analysis, and comparability of data.

The regulations impose key considerations that financial entities need to consider. These include:

Preparing for future regulatory developments is a key consideration for participants. The regulatory landscape is continuously evolving, and participants must stay proactive in anticipating and responding to new regulations. This involves monitoring regulatory trends, participating in industry consultations, and engaging with regulators to provide feedback and influence policy development. Future preparedness ensures that participants remain agile and capable of adapting to emerging regulatory challenges and opportunities.