New Parva office in Luxembourg: 4 questions to Junaed Kabir

The opening of the new Luxembourg office will allow Parva Consulting to be at the heart of Europe’s global fund distribution centre, and large insurance and reinsurance sectors, while supporting the existing clients in Europe and worldwide.

Junaed Kabir, who has more than 30 years of international experience, namely in Business Growth and Global Fund Distribution, will strengthen and expand the skills and relationships of Parva in Luxembourg. We have asked him the key questions to introduce the strategic objectives of this operation.

What kind of market will you manage in Luxembourg?

“Luxembourg is home to 136 international banks, 88 Insurance companies and a leader in global fund distribution. Luxembourg domiciled investment funds are distributed in over 70 countries. 98 of the top 100 asset managers have fund domiciled in Luxembourg and 90% of global private equity investments are structured using Luxembourg products”.

What will be the Parva core services in Luxembourg?

“We’ll focus on Distribution & Growth strategies, Project, Program and Change Management support to Asset Management, Securities Services and Insurance clients”.

Why is this new opening in Luxembourg strategic for Parva?

“As Luxembourg is the largest fund centre in Europe with AUM of over €4.5 trillion the opening of the Luxembourg office enables Parva to be at the core of the global fund distribution centre, supporting our clients in Europe and Globally. The focus on our customers, Delivery, Digital Innovation and new Partnerships will be the main drivers of our growth in Luxembourg”.

Will you hire new resources? What kind of skills are essential to work on a “glocal” Team?

“As we build up our local presence, I will be looking for team members whose values are synergistic to Parva’s values, and with the multicultural, multilingual and global nature of business in Luxembourg”.

Share this article:

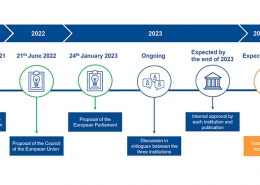

Towards AIFMD II, the ongoing legislative process: where are we?

DORA who? D.O.R.A. regulation.

Parva Consulting Earns Great Place to Work Certification™