Retail Investment Strategy (RIS): the reform of the regulatory framework for retail customers

By Luca Cecchini & Federico Lusian

What is Retail Investment Strategy ?

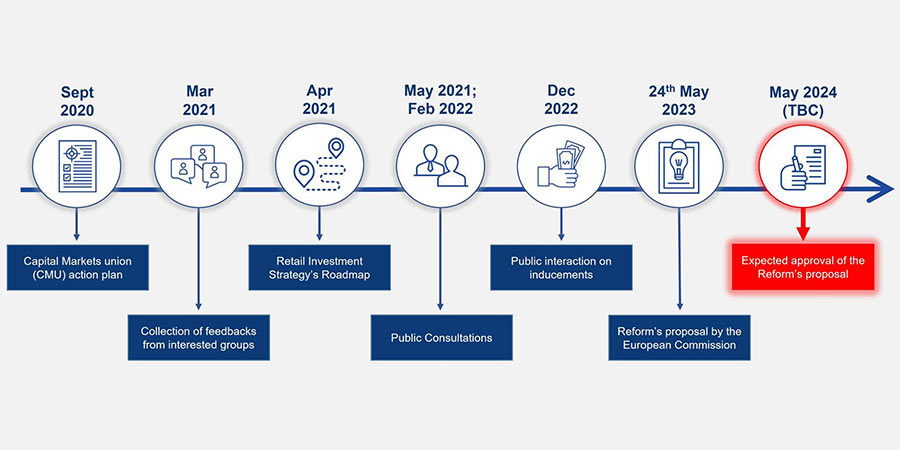

In 2020 the European Commission (EC) published a revised action plan of the initiative known as Capital Markets Union (CMU) with goal to increase the participation and confidence of retail investors in capital markets.

Several targeted initiatives have been implemented, including RIS, a legislative package to review existing regulation (MiFID II, IDD, UCITS, AIFMD, Solvency II, and PRIIPS) for retail investors.

The initiatives primary goal of the initiative are as follows:

- Strengthen the regulatory framework so that retail investors can make decisions that match their requirements and needs;

- increase the level of retail investor protection by developing a comprehensive view of investor’s protection rules;

- channel private capital into the EU economy and fund the digital transition and the European green deal.

Public consultations and interactions on inducements: what emerged?

In order to gather feedback on the current regulatory framework for retail investment, the EC held two large public consultations and a public interaction related to inducements, a topic widely debated because of potential conflicts of interest due to the cost structure of products and the way advisors are remunerated.

In terms of inducements, the EC proposed changing the current commission system from a “Commission based” model to a “Fee based” model in which the customer, rather than rewarding only a “Management & Performance fee” to the asset manager, as is currently the case, also pay an “Advisory fee” directly to the distributor.

A similar model is already in place in the United Kingdom (since 2012) and in the Netherlands (since 2014). In both cases, a significant increase in execution-only services and IMA products for clients with portfolios over 50,000 euros was noted following the ban of inducements. There has also been a decrease in fees related to retail investment products, which didn’t lead to the expected reduction in management fees.

The European Commission noted the results of all public interactions on inducements, which showed that several states, such as Germany and Austria, were opposed to a ban of inducement considering it a “serious step backward” for the European market, as it would limit consumer choice. In conclusion, the EC decided that the reform will not include a universal ban on inducements for financial advisory. However, measures will be taken to enhance transparency requirements and the conditions under which inducements are allowed. In particular, inducements will be banned in the case of execution-only services.

What does the directive include?

Based on the findings of the public consultations carried out, the EC presented a proposal for RIS reform on 05/24/2023 in which the following measures are included:

- promote more conscious financial choices among consumers by encouraging member states to implement national policies that promote financial education for citizens, regardless of age and social-educational background;

- standardize cost disclosure to increase transparency to retail investors by providing them a clear overview of the costs and performance of their investment portfolio each year;

- provide the competent authorities with new enforcement powers (suspend/ban/remove marketing communications) to ensure that retail investors are protected from misleading marketing practices;

- raise professional qualification standards for financial advisors by reviewing the suitability and appropriateness requirements under MIFID II and IDD and incorporating knowledge regarding sustainable investments into their training;

- prohibit inducements for “execution-only” sales and ensure that financial advice is aligned with the interests of retail investors;

- review suitability criteria for the professional investor category, with the aim of reducing administrative burdens and adjusting eligibility criteria for “sophisticated/advanced” retail investors;

- implement a single, standardized questionnaire containing clients information, focusing on the investor’s portfolio and allowing its portability with other financial intermediaries (online brokers, online platforms);

- improve transparency and cost comparability through the use of standardized benchmarks for all financial institutions to ensure a real “value for money” for retail investors;

- review the KID that is regulated in PRIIPs, improving its clarity and introducing a section on sustainable investments, in order to adapt it to the changing needs of investors and the increasing use of digital devices.

What are the next steps?

Unlike the entry into force of a new directive, where adaptations of national regulations to the European text must be implemented by Member States within twenty-four months (but allowing for immediate application of the provisions), for RIS, that is an amendment to existing directives, the legislative process requires that:

- an agreement between the European Parliament (EP), the Council of the European Union (CEU), and the European Commission (EC) is approved within one year – in this case by May 2024 (TBC);

- member States adopt and publish the agreement within 12 months. Usually, the provisions will be implemented 6 months after the adoption.

Share this article:

Navigating the Regulatory Landscape: Key EU Regulations Shaping Private Markets

Parva Consulting announces the promotion of Federico Lusian to Associate Partner

Transforming the Financial Sector through Advanced Data Analytics