The Corporate Sustainability Reporting Directive (CSRD) In Focus

The Next Evolution in ECG Compliance and Sustainability Reporting

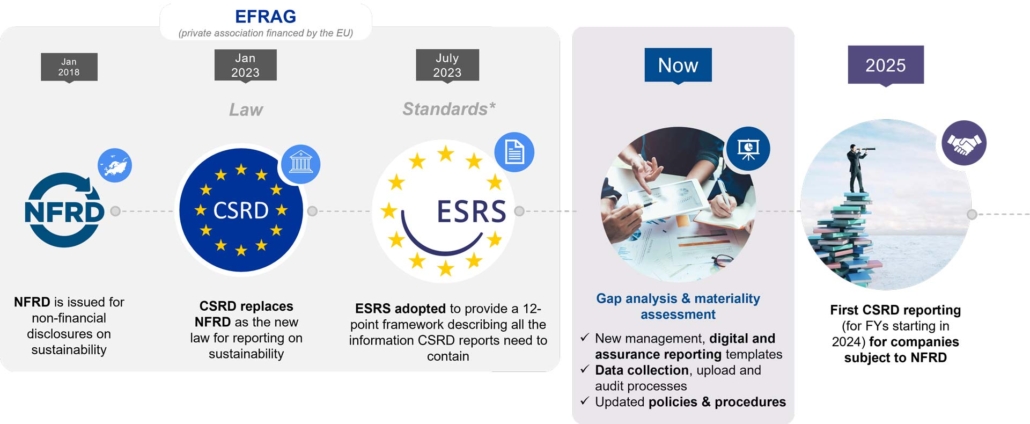

The Corporate Sustainability Reporting Directive (CSRD) arises from the European Green Deal’s climate change action objectives, to further enhance the disclosures originally mandated by the CSRD precursor, 2018’s NFRD (Non-Financial Reporting Directive) legislation.

What this means for companies, is that there is now a requirement for certain entities to report on governance structures, strategy and business models and the output of a materiality assessment in relation to material sustainability matters and topics for their undertaking.

Background to CSRD

The EU is striving to ensure that citizens and investors have a clear understanding of the sustainability impacts of the businesses they are investing in, and how they are deploying capital. In fulfilling this goal, the European Commission contended that existing legislation was falling short.

“Reports often omit information that investors and other stakeholders think is important. Reported information can be hard to compare from company to company, and users of the information are often unsure whether they can trust it.” – The European Commission.

Enter CSRD which has its roots in the NFRD regulation on financial disclosures that came into effect in 2018. The CSRD coupled with the European Sustainability Reporting Standards (ESRS) (created by the European Financial Reporting Advisory Group (EFRAG) – a private association financed by the EU) standards are now seeking to enhance the groundwork laid by NFRD, with first reporting by in-scope entities due to be published in 2025 (for FY 2024).

Who is impacted?

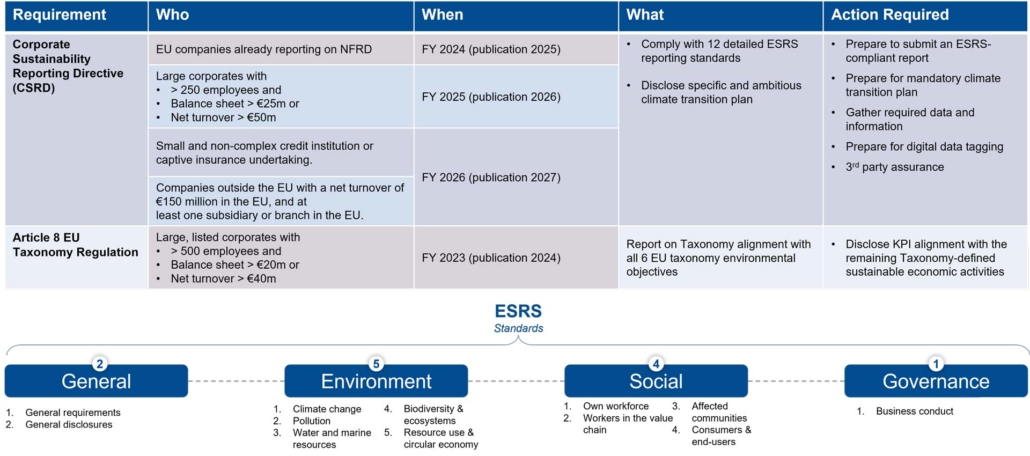

Although CSRD has been adopted as of 2022 by the European Commission, its rules will come into force on a phased basis from 2024 – 2028. In the immediate future, companies that are already in scope for the NFRD regulations are in scope for reporting on CSRD for financial year 2024, and must conduct an end-to-end operating model assessment to understand impact and how to address.

Smaller public-interest entities can report according to their size, but all parent companies of large groups should prepare sustainability reporting at the group level. Nonetheless, subsidiaries will be exempted if the consolidated management report of their parent company adheres to EU reporting norms (or equivalent standards recognized by a third country).

As for small businesses, the CSRD does not impose additional reporting obligations on them, with the exception of those whose securities are listed on regulated markets. Furthermore, to simplify the process for listed Small and Medium Enterprises (SMEs), they are permitted to use streamlined standards for reporting carefully tailored to their size and scale.

What about those that are part of a larger supply chain?

While the CSRD will initially target larger organizations, smaller companies should evaluate if they need to report data, especially if they are part of a larger supply chain where clients may need supplier data for their own CSRD reports.

In terms of what exactly is to be reported on, the 12 ESRS technical standards define this across a number of domains. Two are sections covering general requirements and general disclosures that cover broad environmental, social, and governance topics. In addition to these there are also 5 Environmental, 4 Social, and 1 Governance.

The format of this reporting has also been outlined in the regulation to include:

- Mandatory digital reporting in European Single Electronic Format (ESEF): Companies must prepare their financial statements and management report in XBRL (XHTML) or electronic format in accordance with the ESEF regulations and the EU sustainability taxonomy. They then need to digitally ‘tag’ their reported sustainability information according to a digital categorisation system specified by the CSRD Regulation to make the information machine-readable for use in the European Single Access Point as part of the Capital Markets Union Action Plan aimed at enhancing access to data.

- Externally published Management Board Report which must verified for accuracy by an independent third party.

- Application of a double materiality lens in reporting.

- Alignment with existing regulations including EU Taxonomy, Sustainable Finance Disclosure Regulation (SFDR) and Corporate Sustainability Due Diligence (CSDD) disclosures.

What is to be reported under CSRD, and what do they mean for impacted entities?

- Double Materiality: This refers to the two-way relationship between a company’s operations and sustainability. It involves understanding how a company’s activities affect people and the environment, and how sustainability-related developments can influence the company. A subject is deemed significant if it has a substantial impact from either or both viewpoints. For example, a bank might need to evaluate its environmental impact (like lending to high-carbon industries) and how environmental shifts (like climate change risks) could alter its credit risk profile. This might necessitate considerable modifications in risk management procedures and systems.

- Value Chain Information: Companies are encouraged to share details about their value chains, considering the proportionality and relevance of such information, particularly when procuring from small and medium-sized enterprises or emerging markets. This could necessitate the establishment of new processes for collecting ESG data and conducting due diligence.

Here companies will have to report on their scope 3 emissions, which are emissions resulting from activities not directly controlled by the company but indirectly influenced by its value chain. These emissions are notoriously challenging to quantify and will require significant effort to understand, especially given the EU’s reporting deadlines.

The information reported must adhere to quality standards, ensuring it is understandable, relevant, verifiable, and comparable, and reports should include a mix of forward-looking, retrospective, qualitative, and quantitative information as dictated by the standards.

- Global Standards Alignment: Sustainability reporting should be in line with global standard-setting initiatives, existing frameworks, and related EU regulations. Companies may need to align their reporting with both the CSRD and other international standards like the Sustainability Accounting Standards Board (SASB). This could necessitate changes in data collection and reporting processes, and potentially new IT systems to manage and integrate data from various sources.

- EU Taxonomy / CSDD / SFDR: The new CSRD proposition is designed to guarantee that businesses disclose the data required by investors and other financial market players who are governed by the SFDR. In particular, this implies that the reporting criteria would encompass metrics that align with those found in the SFDR.Similarly, entities already within the NFRD’s scope are also required to report on their alignment with the Taxonomy. The CSRD is closely linked to the EU Taxonomy (a classification system that defines environmentally sustainable economic activities), and several other sustainability directives. Companies within the CSRD’s scope will also have to comply with the EU Taxonomy (and sustainability reporting generally) which will be reported in companies’ annual sustainability reports, and might be included as a part of annual financial reports or otherwise closely linked to financial disclosures

- Industry-Specific Information: The Commission will specify additional industry or sector-specific information to be reported. This will require continuous monitoring and adaptation, and potentially new roles or teams to manage. The CSRD mandates the European Commission to adopt sector-specific standards by 30th June 2024 (with high-risk sector standards published first). Additionally, companies will need to comply with new or revised standards, as these are expected to be reviewed at least every three years by the Commission.

- Assurance and Requirements: The CSRD will require that sustainability information receives external limited assurance (as opposed to reasonable assurance which is more onerous) to ensure accuracy. This means that a third party would need to verify the sustainability information to a certain extent, which can provide more confidence in the reported data. The limited assurance requirement will shift to reasonable assurance after 6 years from adoption of CSRD.

- Digital Format: Companies would be required to publish their sustainability information in a digital format to ensure that it is more accessible and easier to use. Sustainability data will have to be submitted in a standardized digital format, to allow for easier checking and comparison in the European single access point database.

- Extraterritorial Reporting: The Guidelines stipulate that companies from outside the European Union (third-country undertakings) that have substantial activities within the EU must also provide sustainability information, particularly about their social and environmental impacts.Non-EU parent companies are exempted if they release information that matches EU norms and includes details about the subsidiary, provided this information is accessible when the subsidiary issues its management report.

Benefits of CSRD

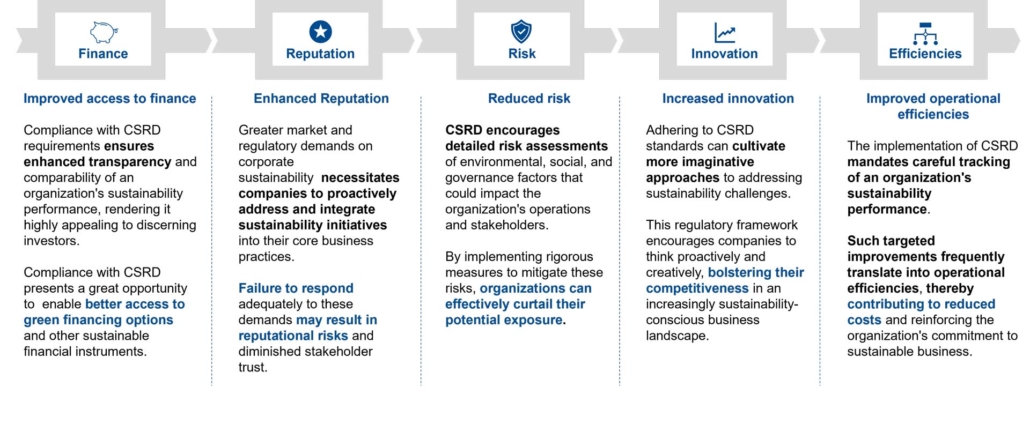

Beyond compliance, integrating CSRD into a company’s overall business strategy can unlock profit and purpose, protect reputation, and drive growth. It also presents an opportunity for companies to enhance their sustainability practices, attract investment, and the process of complying with CSRD itself can spur innovation, encouraging companies to devise new methods to enhance their sustainability performance.

What do companies need to do next?

With fiscal year 2024 (reports published in 2025) already upon us, impacted parties must ensure they are taking appropriate steps to be compliant. As CSRD continues to widen its reach to more and more companies, it is imperative that all impacted firms should:

- Assess the extent the new sustainability directive impacts your organization

- Determine your company’s existing position and materiality reporting obligations

- Develop a roadmap for new compliance reporting

For more insights and guidance on CSRD, reach out to Parva Consulting’s team to explore how we can assist you with your regulatory compliance needs.

Share this article:

Navigating the Regulatory Landscape: Key EU Regulations Shaping Private Markets

Parva Consulting announces the promotion of Federico Lusian to Associate Partner

Transforming the Financial Sector through Advanced Data Analytics