The role of governance in tackling environmental and social issues

by Christian De Angelis

Why governance is a key driver towards ESG compliance?

Governance is the most underappreciated of the three ESG pillars, yet it is the most important to focus on due to its ability to address and coordinate the others whose impacts are most visible outside of company.

The board of directors plays an important and active role in determining policy and governance in integrating sustainability risks into the decision-making processes as well as organisational and operational structures.

Once the company’s ESG aim has been determined, the board must address two practical issues:

- the delineation of roles and responsibilities;

- the definition of acceptable information flows.

Roles and responsibilities definition

Companies must define roles and responsibilities for ESG issue management, adopting a customised approach that is adapted to their needs.

The chosen approach has to be structured and formalised as part of a “ESG Policy”, whilst clearly defining an internal framework, its committees and how they will interact.

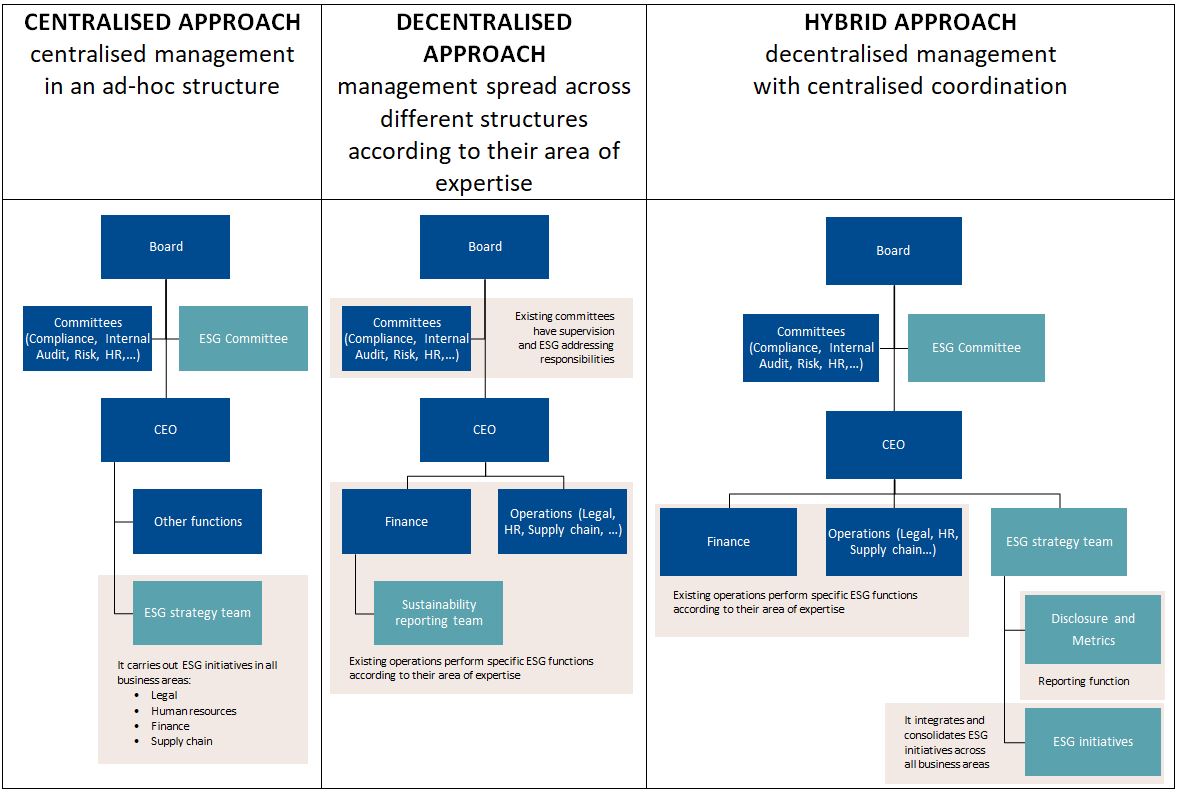

As every company is unique, we have outlined three possible governance approaches your company can explore as a starting point for adapting governance for ESG purposes.

Every approach has advantages and disadvantages:

- completely new committees and functions can be composed of ESG experts hired from outside the company who are already experienced but are likely to be more expensive than internal resources;

- when adding new functions, a new TOM (target operating model) must be defined to integrate them into the corporate mechanisms, time is needed to recreate previous operational and political balance;

- adding ESG requirements and responsibilities to existing functions will create additional workload;

- activity coordination, led by a dedicated ESG team, may be seen as interference across the more “traditional” functions.

Adequate information flows definition

The Board must develop enough information flows for an effective and reliable decision-making process once the new governance strategy has been defined.

The governing body must establish a reporting system on environmental and social risks with a focus on the medium-long-term outlook, detailing content, senders and receivers, frequency:

- set appropriate and measurable key performance indicators (KPIs) and key risk indicators (KRIs), such as (not exhaustive):

- % sustainable revenues/CapEx/OpEx, mainly for non-financial companies;

- Green Asset Ratio (GAR), Banking Book Taxonomy Alignment Ratio (BTAR), mainly for financial companies;

- create a data production and management control architecture within the company and along the value chain;

- schedule periodic checkpoints in order to monitor and analyse position towards targets, performing a gap-analysis.

Looking ahead to EFRAG standards

EFRAG, which is drafting CSRD implementation standards at the request of the EU, has emphasised the importance of Governance by dedicating the ESRS G1 – Business conduct to it which will come into effect on 1/1/2024.

Companies will be required to make disclosures of:

- the role of the administrative, supervisory and management bodies;

- description of the processes used to identify and assess material impacts, risks and opportunities;

- corporate culture and business conduct policies;

- management of relationships with suppliers;

- prevention and detection of corruption or bribery;

- confirmed instances of corruption or bribery;

- political influence and lobbying activities;

- payment practices.

Looking ahead

Our aim at Parva Consulting is to give added value to our clients, and governance is just one single piece of the puzzle. Regulation is evolving, CSRD is now a solid reality, EFRAG has released ESRS drafts. The EU taxonomy is expanding the list of “eligible” activities, outlining the criteria for inclusion. Another key problem is data management: identifying the right sort of data for investigation and monitoring needs, as well as establishing the right internal framework is critical for ESG evolution.

We look forward to examining this further in future articles!