Fintech Lending Trends: The Road Ahead for Financial Institutions

by Emilio Ronconi

Innovation and change is immune to no sector, not even the credit market, which until now has been dominated by banks, is spared from confronting new ways of conceiving lending. Bank capital regulations, the unstoppable development of IT, and the demand for flexibility, contextuality, and speed in credit provision by individuals and businesses have created fertile ground for fintech companies to implement innovative solutions.

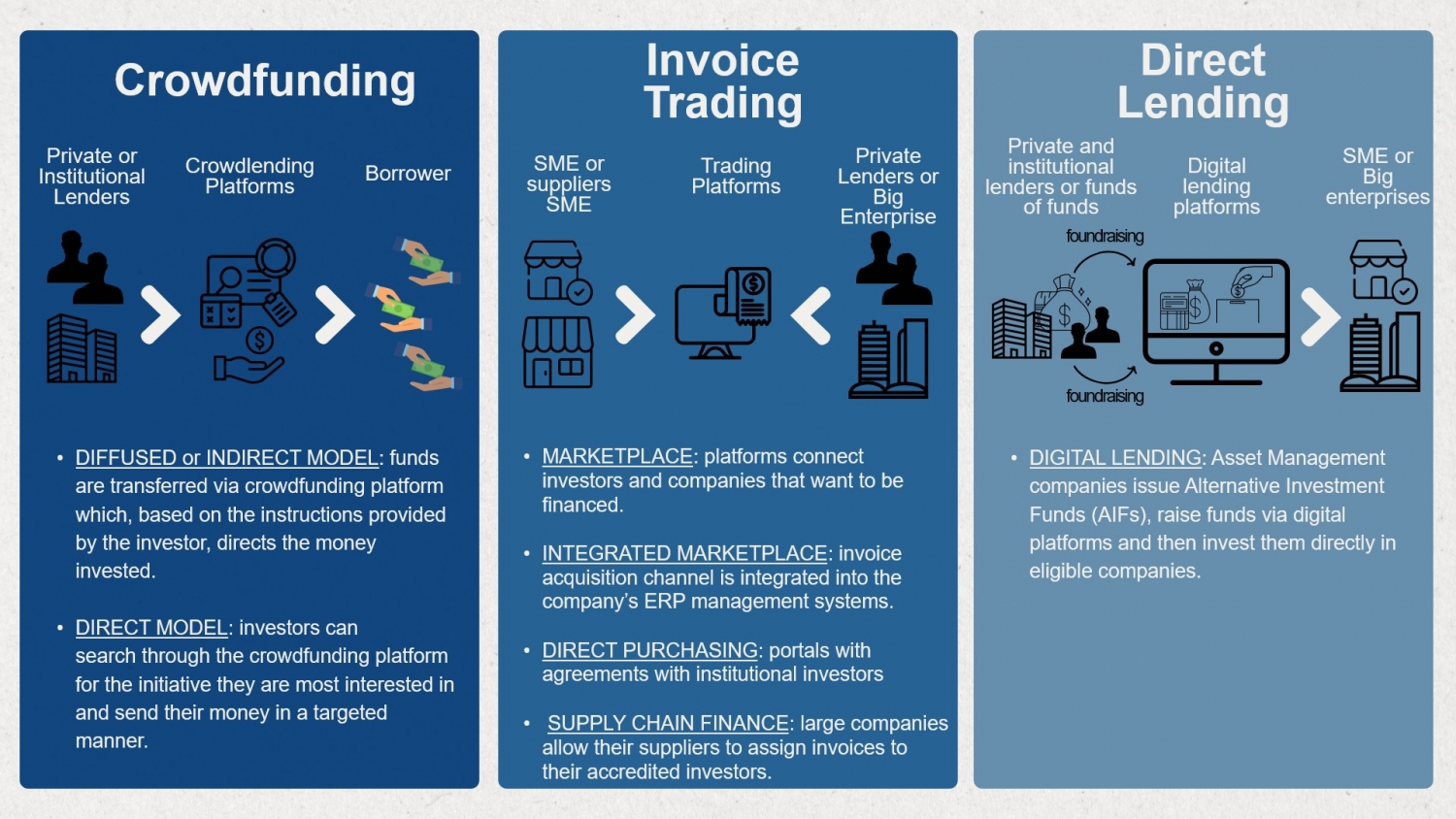

Crowdlending, invoice trading, and direct lending are three fintech lending operational models that have grown in popularity over the previous five years. Fintech lenders distinguish themselves from traditional players through the automation of the screening, pricing, and approval processes, using innovative methods and technologies that meet the market demand for quick and bespoke solutions.

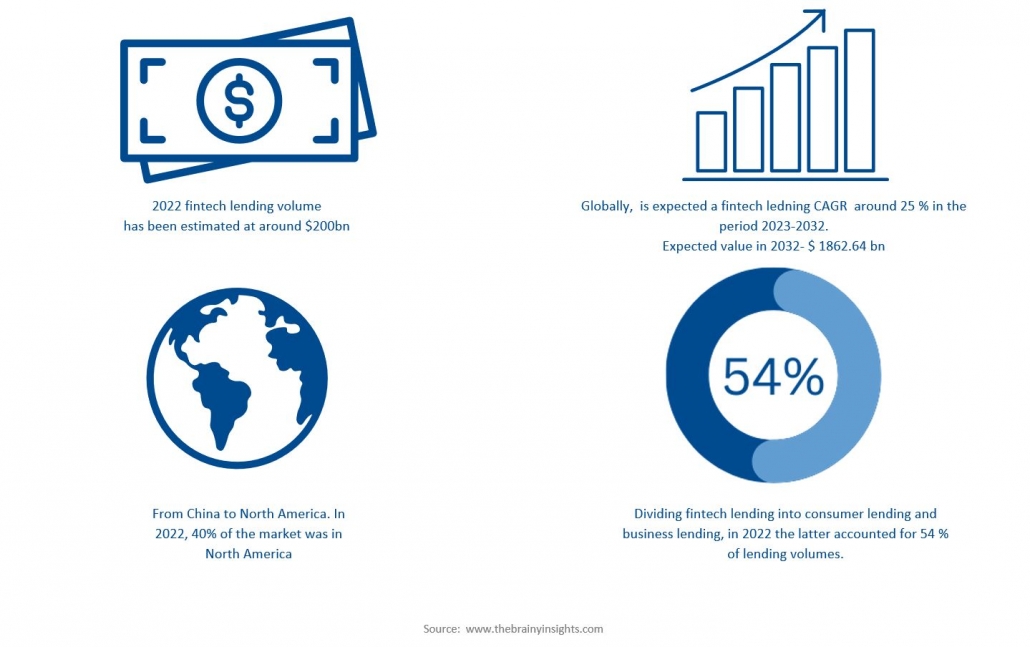

Fintech lending has simplified financial transactions by increasing accessibility whilst reducing response times and management costs. The increasingly widespread acceptance and use of this new lending concept, both by investors and fund applicants, is confirmed by multiple forecasts: for fintech lending, in the period 2024-2027, is estimated a Compound Annual Growth Rate (CAGR) of 32.3%, with an outstanding volume of loans “disbursed” for more than 400 billion USD (Insight Industry Guru, 2024). Other estimations, up to 2031, predict an outstanding amount of more than 1.8 trillion USD (The Brainy Insight, 2022).

However, as rapid as the fintech lending explosion may be, it is still far from the volumes of the banking sector. In Italy alone for instance, the total loans in the private sector (Italian residents only) amounted to 1.48 trillion euros in December 2023 (ABI, 2024).

From this brief analysis, the question that arises is:

What will be the future interaction between fintech lenders and “traditional” bank intermediaries?

Fintech lending and bank credit: the evolution of their relationship between past, present, and future

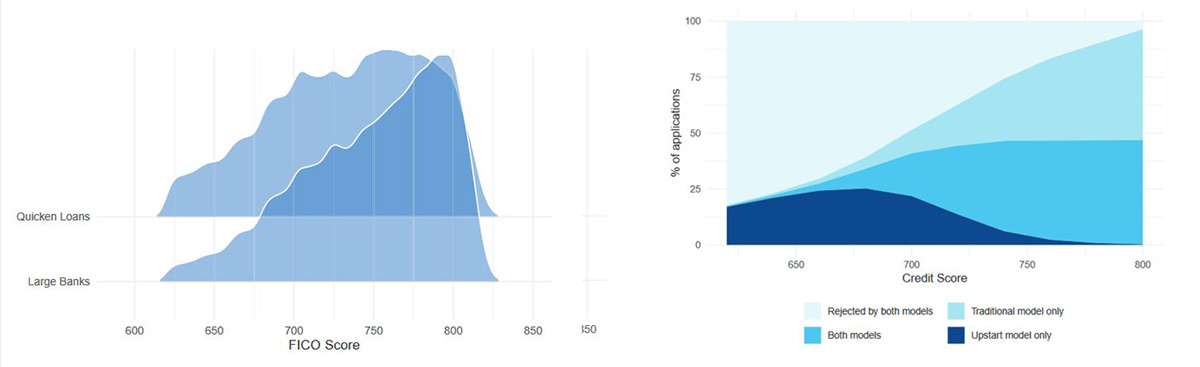

Past: Fintech lenders emerged and developed by exploiting the market gap left by banks. Fintech lenders choose these types of borrowers as their reference market because of their competitive advantages in providing loans to risky clients, such as startups and SMEs, and provide them tailored and quick-delivery solutions. In fact, when the distribution of loans disbursed through fintech lenders and banks is compared, it is observed that the former service a clientele that is generally riskier (as assessed by FICO score) than the latter, which prefers high-grade borrowers (Di Maggio et al., 2022).

There are several factors contributing to this disparity in client coverage, but the two main ones are capital regulations that banks are subject to (but not fintech lenders) and fintech lenders’ higher default probability calculations.

Present: Taking advantage of complementary competitive advantages, banks and/or fintech lenders have occasionally started joint ventures or M&A projects to broaden the range of products they offer on the market and take advantage of synergies created in the analytics, customer support, risk management, and onboarding domains. Fintech companies and banks have successfully collaborated on several credit-related projects, as evidenced by Il Sole 24 Ore (2022). These projects have included the integration of novel fintech technologies into supply chain finance procedures and the use of invoice trading solutions to establish new platforms and systems that enhance working capital and cash flow management for corporate clients.

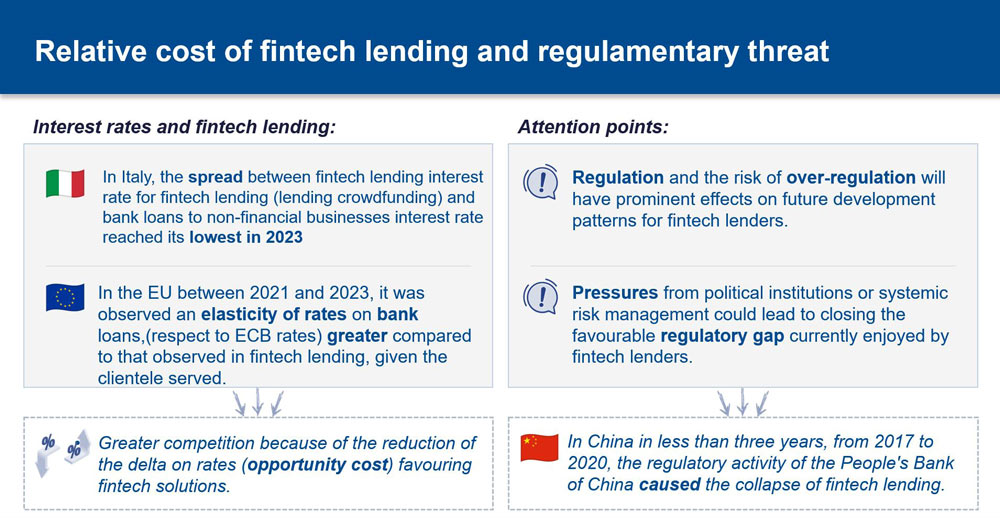

Future: As we approach typical fund applicants’ FICO score values, the substitutability and hence competition between traditional and fintech lending increase. For banks, engaging clients with lower credit ratings results in a rise in the interest rates paid, lowering the trade-off for customers between fintech and traditional lending. Customers that see a lesser difference in interest rates between the two options may choose the customer-friendly products offered by fintech companies. Data confirms the increase in competition on the credit cost side: in Italy, the interest rate differential between crowdlending and bank lending reduced by 200 basis points between 2022 and 2023 (from 600 basis points to about 400 basis points) (Politecnico di Milano, 2023; Banca d’Italia, 2024).

To summarise, the challenge posed by the growth of fintech lending to bank credit does not appear to materialise in a scenario of complete substitution of one option for the other. The end-result appears to be a spectrum of various complementary-cooperative interactions, with areas of partial substitutability between the two possibilities. It is important to note that the area of “conflict” and substitution is not statically positioned at typical FICO score values (or other credit scores). If fintech lenders continue to receive substantial amounts of liquidity from institutional investors, as ensured by advanced risk assessment techniques, the interest rate offered will inevitably fall. This change in supply conditions would attract customers who were previously well-served by bank intermediaries.

In this sense, the ideal method for banks to address changes would be to adapt their internal IT system architectures to accept automated, digitised, and AI-based activities. AI tools, such as Natural Language Processing (NLP), are useful for customising and optimising the support system-client interaction in order to meet customer demand for digitised products, particularly from Generation Z (S&P Global, 2024).

A final aspect to be carefully monitored is the parallel political-regulatory evolution of new lending models. The great flexibility of fintech lenders resulting – also – from less restrictive regulations than the banking ones, can be reduced and nullified by stringent and unaccommodating regulations. A good example can be China, where regulatory measures enacted by the People’s Bank of China (PBoC) in 2017 (Cornelli et al., 2020) contributed, in just 3 years, to the collapse of the annual fintech lending volume, which plummeted from over 200 billion USD to just over 1 billion USD in 2020 (CCAF) with thousands of platforms failing.

Reference

- Associazione Bancaria Italiana (2024). Economia e Mercati Finanziari-Creditizi Gennaio 2024 – Sintesi. https://bancaria.it/assets/rapportiabi/2024/82a5411b58/2024-01.pdf

- Cornelli, G., Frost, J., Gambacorta, L., Rau, P. R., Wardrop, R., & Ziegler, T. (2020). Fintech and big tech credit: a new database. RePEc: Research Papers in Economics. https://econpapers.repec.org/RePEc:bis:biswps:887

- Di Maggio, M., Ratnadiwakara, D., & Carmichael, D. (2022). Invisible Primes: Fintech Lending with Alternative Data. https://doi.org/10.3386/w29840

- Il Sole 24 Ore (2022). Fintech e banche alleate, cinque casi in cui è stato creato valore. https://www.econopoly.ilsole24ore.com/2022/05/13/fintech-banche-alleanze/?refresh_ce=1

- Industry Insight Guru. (2024). Fintech Lending Market Size Poised to Surpass US$ 3100520 million with Accelerating CAGR of 32.3% by 2031. https://www.linkedin.com/pulse/fintech-lending-market-size-poised-surpass-us-3100520-gkmde#:~:text=Market%20Analysis%20and%20Insights%3A%20Global,32.3%25%20during%202024%2D2027

- Politecnico di Milano. (2023). Osservatori Entrepreneurship Finance & Innovation. 6° Quaderno di Ricerca La Finanza Alternativa per le PMI in Italia. https://www.osservatoriefi.it/efi/report-e-pubblicazioni/#

- S&P Global. (2024). 2024 Trends in Customer Experience & Commerce. https://pages.marketintelligence.spglobal.com/rs/565-BDO-100/images/SPGMI_Preview_CXC_2024_FINAL.pdf?version=0

- https://ccaf.io/

- https://infostat.bancaditalia.it/

Share this article:

Navigating the Regulatory Landscape: Key EU Regulations Shaping Private Markets

Parva Consulting announces the promotion of Federico Lusian to Associate Partner

Transforming the Financial Sector through Advanced Data Analytics