Has the Reserved Alternative Investment Fund (RAIF) increased the competitiveness of the Luxembourg market?

by James Lett & Pierluigi Meloni

Approximately seven years after the introduction of RAIF funds into the Luxembourg fund market, following the passing of the law of 23 July 2016, we aim to explore their distinct features, amendments and updates, and evaluate their entry within the Luxembourg fund market.

RAIF legislation

The Luxembourg fund market has consistently stood out due to the government’s proactive approach in developing and implementing regulations for financial services products and companies active in the creation and distribution of such products. This approach has played a significant role in furthering the growth of the financial sector.

The implementation of the Alternative Investment Funds Directive (AIFMD) in July 2013 introduced dual-level supervision for both the fund and the manager of alternative investment funds. In response, the Luxembourg government introduced the law of 23 July 2016 aiming to differentiate its offerings. This legislation supplemented existing structures such as Specialised Investment Funds (SIF) and Risk Capital Investment Company (SICAR) and introduced the RAIF (Reserved Alternative Investment Fund).

The RAIF Fund Directive allows for the establishment of alternative investment funds adhering to AIFMD, which, although using a variety of corporate and contractual forms combining the same characteristics and structuring flexibilities as the regulated investment instruments SIF and SICAR, are unique and exempt from direct regulatory approval and prudential supervision by the Commission de Surveillance du Secteur Financier (CSSF).

Main features

RAIFs, qualifying as alternative investment funds, must appoint a fully licensed alternative investment fund manager from Luxembourg, another EU Member State, or a third country with a European passport. Typically structured as umbrella funds, RAIFs cater exclusively to ”well-informed” investors and require a minimum subscribed capital of EUR 1,250,000. This minimum must be reached within a period of 24 months following its authorisation. At least 5% of the capital must be paid up at subscription. Like SIFs, RAIFs also have a 30% cap on asset investment in a single venture, with exceptions under certain conditions. An annual subscription fee of 0.01% is applied to RAIFs, though this is waived for funds investing solely in risk capital thereby allowing the option to adopt the SICAR tax regime.

Eligibility for investment in RAIFs is limited to ‘well-informed’ investors, who can adequately assess the risks associated with an investment in such a vehicle. These investors are defined as institutional or professional investors, as well as those who have confirmed in writing their adherence to the ‘well-informed’ investor status. Additionally, they must either invest a minimum of EUR 100,000 in the RAIF or have been assessed by a credit institution, investment firm, or management company. This assessment certifies the investor’s expertise, experience, and knowledge in adequately appraising an investment in the RAIF.

Improvements and Modersnisation of the Luxembourg Investments Funds Toolbox

The Law of 21 July 2023 represents a significant modernisation of Luxembourg’s investment fund laws. It is formally referred to as Bill of Law No. 8183 and amends several existing Luxembourg laws, including:

- The Law of 15 June 2004 relating to the investment company in risk capital (SICAR Law)

- The Law of 13 February 2007 relating to specialised investment funds (SIF Law)

- The Law of 17 December 2010 relating to undertakings for collective investment (UCITS Law)

- The Law of 12 July 2013 on Alternative Investment Fund Managers (AIFM Law)

- The Law of 23 July 2016 on Reserved Alternative Investment Funds (RAIF Law)

The proposed changes, to be read in conjunction with the new ELTIF (European Long-Term Investment Fund) regime, are a response from the Luxembourg legislator to the increasing trend of alternative fund managers seeking to raise capital from retail investors across the world.

The primary objective of this new law is to improve and modernise Luxembourg’s fund products, thereby increasing the attractiveness and competitiveness of Luxembourg as a financial centre. Among the number of amendments, the following are of particular interest in the context of RAIFs:

- Amendment of the definition of “well-informed investors” under the SIF Law, the SICAR Law and the RAIF Law: The definition of “well-informed investors” across the SIF, SICAR, and RAIF Laws is harmonised with a clear cross-reference to “professional investors” as defined under MiFID II. The minimum investment threshold of EUR 125,000 is also lowered to EUR 100,000 to reinforce the coherence between the different laws and to align the Luxembourg regime with the European standard.

- Extension of the deadline to meet the minimum amount of assets under management: Previously, both SIFs and RAIFs were required to attain a minimum subscribed capital of EUR 1,250,000 within 12 months of their authorisation. Meanwhile, SICARs have a slightly lower threshold of EUR 1,000,000, which also had to be met within the same 12-month period following authorisation. The updated Law extends the time limit for SIFs, RAIFs, and SICARs to reach the legal minimum of their subscribed capital from 12 to 24 months.

- Marketing of RAIFs, SICARs and SIFs to retail investors in Luxembourg: The new Law will amend the RAIF Law and the AIFM Law to clarify RAIFs and allow SICARs and SIFs, to be marketed to non-professional investors (retail investors) in Luxembourg provided they qualify as well-informed investors.

- Notarial Confirmation No Longer Required in Certain Cases: The new law introduces amendments to the RAIF Law which concerns the procedures for recording a RAIF’s incorporation with the Luxembourg notary and the Luxembourg trade and companies register. Under these amendments, the requirement for notarial confirmation of a RAIF’s setup is now not required as long as the RAIF has already been established through a notarial deed. The law now distinguishes between funds incorporated by notarial deeds and those established under private seals.

- Obligation to maintain up-to-date information: The law introduces a new obligation whereby any modification to the information included in the registration of a RAIF in the official list must be informed to the Register de Commerce (RCS) within 20 working days following the effectiveness of such modification.

- Subscription Tax for ELTIFs: Part II UCIs, RAIFs and SIFs authorised as ELTIFs are exempt from subscription tax, with the laws clarifying the conditions to be met to benefit from the exemptions.

Volumes

Initially, RAIFs saw a modest uptake, with about 15 registrations in the first quarter post-introduction. However, this trend accelerated, with an average of over 10 new funds registered monthly following the first 10 months after the introduction. As of August 2017, 158 RAIF facilities were installed and registered in the Luxembourg RCS (Trade and Companies Register), finally reaching 277 in January 2018. As of June 2020, there were 1,062 RAIFs, representing an increase of 52% compared to the previous year. By late 2023, the number of RAIFs had risen significantly, reaching approximately 2,301, thus highlighting the growing popularity and utilisation of RAIFs in Luxembourg’s financial landscape.

Acceptance

Despite initial apprehensions at the time of their introduction, primarily linked to the lack of CSSF supervision, which could have potentially discouraged investors, RAIFs have gained attraction due to their reduced Time-to-Market.

Their launch did not diminish the demand for SIF and SICAR structures since the decision to opt for a SIF or a SICAR over a RAIF, despite the more complicated approval process, is influenced by the nature of the investors to whom a fund manager is concerned. For instance, some institutional investors, such as pension funds and insurance companies, may prefer fully regulated and supervised investment structures.

Conclusion

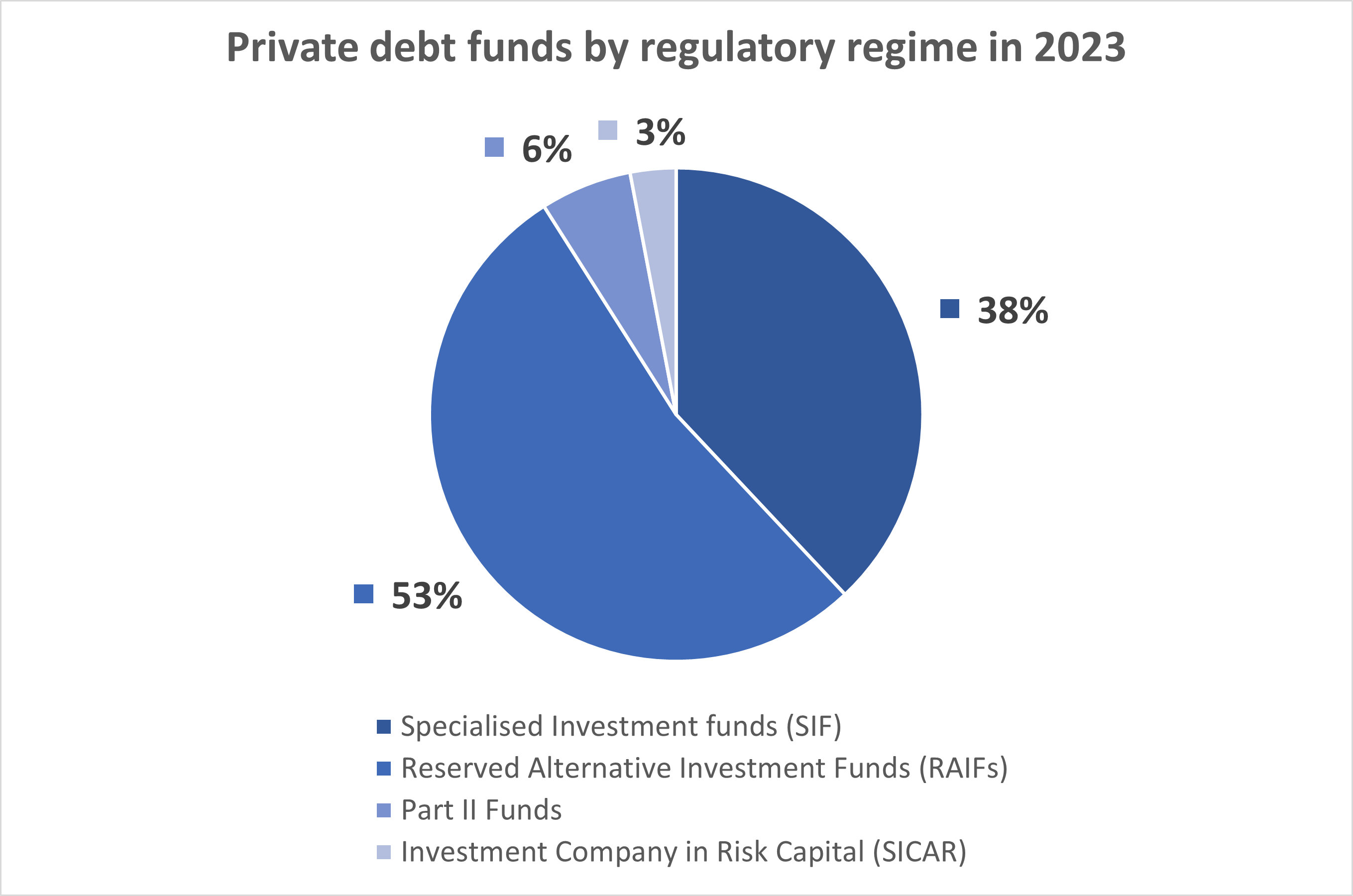

In conclusion, RAIFs have not replaced existing structures, but rather complemented Luxembourg’s market offerings and enhanced its competitiveness. The flexibility and ease of establishment of RAIFs have seen them encompass a broad spectrum of alternative investment strategies, such as private equity, real estate, private debt, and infrastructure funds. This diversity, combined with the flexibility of RAIFs regarding asset class selection and risk diversification rules, and the reduced Time-to-Market, have promoted growing investor interest in RAIFs. The Law of 21 July 2023 brought improvements and modernisation of Luxembourg’s Investment Funds, including RAIFs that have helped the attractiveness and competitiveness of Luxembourg as a financial centre.

Condividi questo articolo

New office in Luxembourg

Financial Services: creating more value with Artificial Intelligence

That’s why Parva is among the best consulting companies in Italy in the Forbes ranking