Sustainable and Responsible Investments: what do you evaluate, when investing?

di Martino Gentilcore e Francesca Lodi

How to promote positive change through asset selection

A brief introduction

Ten years after the financial collapse of 2008, the perception of finance has deeply changed within the society.

In the post-crisis environment, the word itself “finance” (not mentioning “banks” and “financial advising”) has steadily and, somewhat in an irreversible way, assumed a negative implication. Perception of the public has reasonably been worsening. A widespread lack of scope of the financial institutions is therefore perceived, while the benefits of a modern financial systems are often not mentioned or even considered.

So, is there a way to make sure that finance could have positive, tangible and perceivable impacts? Do we know what are the actual implications of our investments on society?

Sustainable and Responsible Investments (SRIs) could be the long-term answer to these complex issues. Let’s start with a definition, given by Eurosif (European Sustainable Investment Forum), the European association for the promotion and advancement of SRIs in Europe:

“Sustainable and Responsible Investments (SRIs) is a long-term oriented investment approach, which integrates Environment, Social and Governance (ESG) factors in the research, analysis and selection process of securities within an investment portfolio.”

7 investment strategies

In practical terms, there are 7 strategies (outlined by Eurosif) aimed at analyzing and selecting securities in order to shape an investment portfolio of this kind. Clearly, these strategies are not “exclusive”, so they could be combined between them.

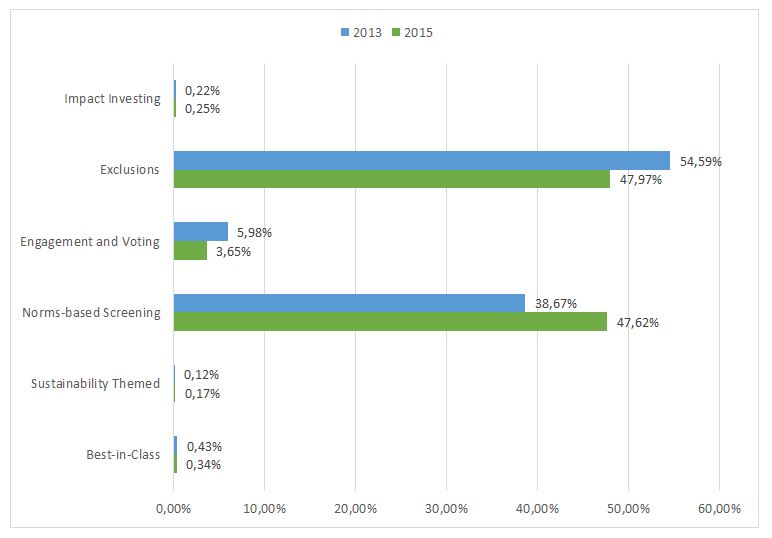

Aiming at showing the current trends of SRIs sector in the European financial market, the 7 strategies are ranked by their market relevance:

- Exclusion of holding from investment universe:

By screening sector and companies, this approach will exclude every security linked to controversial sectors, which are not compatible with ESG criteria. Namely, weapons, nuclear energy, tobacco, gamble, alcohol and animal testing will be left out from the investment universe.

- Norms-based screening:

Basing the analysis on international regulation on the matter (e.g. Principles for Responsible Investments supported by the United Nations), the companies considered must be compliant with the minimum standard of environmental sustainability, human rights, labor standards and transparency.

- Engagement and voting on sustainability matters:

This strategy is surely the most forward-looking, since the scope of the investor is to influence the management of the company through participation as a shareholder. Therefore, the engagement should lead to greater value, by improving business conduct, promoting risk-weighted projects and pushing on ethical/moral considerations.

- ESG integration:

Fundamental and quantitative analysis of prospective investments is explicitly and systematically integrated with ESG factors (e.g. sustainable workplace practices effects on competitive positioning in the retail sector, linking ESG ratings to returns and volatility, etc.)

- Best-in-Class investment selection:

Only the top companies in ESG score will be picked up by investors to compose a portfolio. ESG data are available from the main market data providers, so that firms can be ranked by their behavior regarding environment, social and governance matters.

- Sustainability themed investment:

Asset selection is in this case driven by the research of companies that focus on renewable resources and energy efficiency. So, only the letter “E” of the acronym ESG. Green bonds are one the most famous and discussed example of investments that fall under this strategy.

- Impact investing:

To generate a clearly measurable and positive social and/or environmental impact, alongside with a financial return, by investing in a specific enterprise.

SRIs Industry in Italy[1]

ESG approach when investing is gaining momentum all over the world.

The European market is currently the most relevant, with a total estimated AuM of € 21,000 billion as at 2015, taking into consideration the following investment categories:

- Assets managed by asset managers via pooled products, institutional and retail;

- Assets managed by asset managers on behalf of institutional clients, via separated accounts;

- Assets managed internally by asset owners (self-managed assets).

Italian market accounts for about 3% of European market, for an estimated AuM of € 615 billion.

Following the international trend, also in Italy the largest share is represented by the first and second strategy (Exclusions of holding from investment universe and norms-based screening).

Source: Eurosif – European SRI Study 2016

Focusing on funds, what are the main players in the Italian SRIs market?

A study conducted by Le Fonti Research Centre (an Italian media company which conducts analysis on international business, finance, technology and world affairs) and published by the Asset Management magazine of March-April 2018 gives us an overview about the leading asset managers in the peninsula.

1.108 Italian financial advisors and private bankers have been consulted regarding the clients’ responsiveness to products structured following ESG criteria (clients could choose more than one asset manager).

The results showed that Pictet Asset Management takes the lead with a 31.6 %, followed by a 18.2 % obtained by BNP Paribas AM and Etica Sgr, Italian forerunner in this industry, with 18% of preferences.

| 1. | Pictet AM | 31.59 % | 6. | Fidelity | 12.27 % | |

| 2. | BNP Paribas AM | 18.23 % | 7. | Vontobel | 12.09 % | |

| 3. | Etica Sgr | 18.05 % | 8. | Eurizon | 9.57 % | |

| 4. | Blackrock | 13.00 % | 9. | Azimut | 8.84 % | |

| 5. | Amundi | 12.27 % | 10. | Candriam | 8.12 % |

Source: Le Fonti Research Centre – Survey

Is doing some good also profitable for our portfolio?

Several studies have demonstrated that by investing in SRIs, investors may achieve similar results to strategies which have not integrated ESG factors in their asset selection analysis.

US SIF (The US Forum for Sustainable and Responsible Investment), an association formed by American investments managers, advisory firms, financial advisors and other market players, has indeed published researches that validate and confirm the value of SRIs.

To give an example, the 2015 report by Morgan Stanley “Sustainable Reality: Understanding the Performance of Sustainable Investment Strategies” showed that “investing in sustainability has usually met, and often exceeded, the performance of comparable traditional investments.”

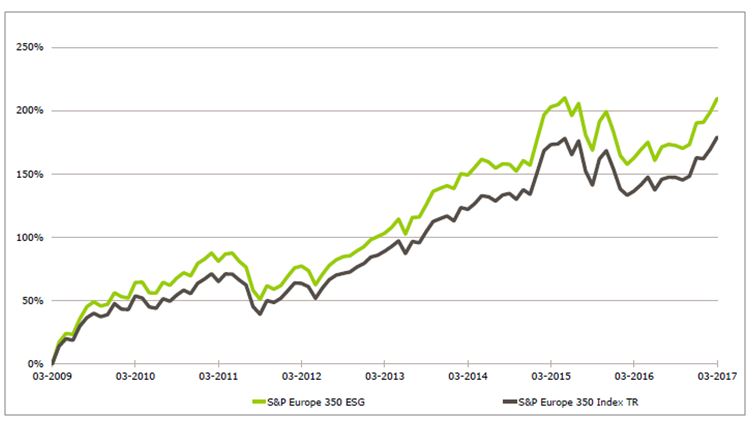

Moreover, the S&P ESG indices, which are based purely on ESG research, help us to understand the real value of SRIs. Focusing on the European market, the S&P Europe 350 index measures the performance of the constituent companies of the S&P Europe 350, with a weighing scheme based on ESG factors. Briefly, companies’ market cap is modified according to their ESG score.

As showed by the following comparison graph on growth performance, the ESG index constantly outperformed the classic S&P Europe 350 index in the recent years.

Source: S&P Dow Jones Indices and RobecoSAM – S&P ESG Indices (March 2017)

In conclusion, being the performance of SRIs comparable to non-SRI portfolios (and in some cases, even better), it is possible to assure that, by investing, we can promote positive implications on society, keeping pace with financial return too.

[1] Source: Eurosif – European SRI Study 2016

Condividi questo articolo

Navigating the Regulatory Landscape: Key EU Regulations Shaping Private Markets

Parva Consulting announces the promotion of Federico Lusian to Associate Partner

Transforming the Financial Sector through Advanced Data Analytics