What regulatory changes can we expect from the IORP II Directive?

By Brian Murru

The EU’s reform of occupational pension legislation has come in the shape of IORP II. The focus of the directive is to raise the bar on governance and communication standards for occupational pension schemes.

While originally introduced in 2003, IORP II was revised in 2016 due to 3 main factors:

- The need for sound governance of financial institutions after the 2008 Financial Crisis,

- An ageing population that continues to shift the pensioner-to-worker ratio, and

- To expand the number of large institutional investors for long term investment in the European economy

IORP II was adopted in 2016 and transposed into Italian legislation on the 1st February 2019 and into Luxembourg law on the 15th December 2019. Meanwhile, the directive has only recently been signed into Irish law on the 22nd April 2021 with a compliance statement due to follow on the 31st January 2022. The regulations set by COVIP in Italy, CSSF in Luxembourg and the Pension Authority in Ireland closely follow the original European directive which impacts those operating Occupational Pension Schemes (OPS), Small Self-Administered Pension Schemes (SSAPs) and Group Company Pension Plans.

In due course we will be providing a focused piece on how the Irish market can anticipate the impacts and requirements of IORP II. In the meantime, we have set out below some of our observations on the regulations.

Objectives

The IORP II directive provides for EU-wide pension scheme standards including an effective system of governance. The changes arising from effective governance, fit and proper requirements and new standards relating to communications with members demonstrate the directive’s focus on protecting members and beneficiaries. The new communication standards aim to provide clear, relevant, and regular information to these members and enhance transparency.

Another objective of the directive is to create an internal market for occupational retirement provision by facilitating cross-border activity by IORPs and cross-border transfer of pension schemes. In theory, it will allow multinational pension funds to consolidate workers’ pension fund savings in a single jurisdiction. This will result in increased scale, cut running costs, facilitate access to new investment classes, and enhance governance and risk management. However, member states with different interpretations of the directive will continue to regulate IORPs on a national basis which may prove a stumbling block for consolidation. Greater consolidation of defined contribution pension plans has already delivered positive benefits in multiple countries. Going forward, the expectation is that employers will begin to see well-structured master trusts, who offer significant value in terms of governance, communication, and cost-effectiveness, as the most viable solution to their pension needs.

What are the Changes and their Impacts?

The changes in governance, risk management and outsourcing will undoubtedly influence the management and compliance of pension schemes. The updated policies and procedures will require tighter management in areas such as risk management, internal audit, outsourcing, remuneration and business continuity planning. Accompanying these extensive changes will be greater regulatory powers. Accordingly, regulation is witnessing a shift from the past approaches which emphasised retrospective reporting and compliance to more prudential supervision that is forward-looking and risk based.

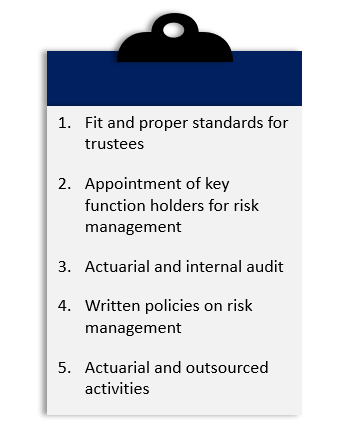

The measures introduced will build important protections and safeguards into pension-scheme management. The new governance, risk-management and internal-audit standards should, over time, result in improved benefit protection and benefit outcomes. There is also increased anticipation for improvements in the quality and frequency of pension-scheme information provided to members. Most notably, there are five key areas that will witness significant changes.

Governance Requirements

Schemes must now put in place an “effective” system of governance and internal controls system, covering several prescribed headings including organisational structure, segregation of responsibilities and transmission of information. The regulations require a much broader scope of member communications, including provision of annual benefit statements to deferred members.

The introduction of IORP II means that pension scheme trustees must carefully examine every aspect of their governance and risk management operations. Trustees will now be subject to fitness, probity, knowledge and experience requirements. The increased pension scheme governance and internal controls will also require schemes’ to carry out an internal audit and have an internal audit function. In all, three key function holders (KFH) must be appointed for core areas of Risk Management, Internal Audit and Actuarial (for defined benefit schemes). These new standards for fit and proper requirements alongside the growing responsibility of trustees and introduction of KFHs will affect how schemes operate and their reporting structures.

The introduction of IORP II means that pension scheme trustees must carefully examine every aspect of their governance and risk management operations. Trustees will now be subject to fitness, probity, knowledge and experience requirements. The increased pension scheme governance and internal controls will also require schemes’ to carry out an internal audit and have an internal audit function. In all, three key function holders (KFH) must be appointed for core areas of Risk Management, Internal Audit and Actuarial (for defined benefit schemes). These new standards for fit and proper requirements alongside the growing responsibility of trustees and introduction of KFHs will affect how schemes operate and their reporting structures.

In addition to one-off implementation efforts, this could leave some schemes facing significant additional governance and compliance costs into the future. Consolidation of existing pension arrangements could prove a solution to easing this burden. However, this is also likely to expedite the closure of more Defined Benefit (DB) plans continuing the trend from DB to DC arrangements.

Extended Supervisory Power

Crucially, the increased powers will ensure that regulators have the necessary powers and tools to effectively supervise IORPs. Amongst their powers, the regulators such as the Pension Authority can carry out supervisory reviews and require schemes to undertake a stress test.

There are also updated rules relating to the operation of cross border schemes and transfers between schemes in the EU. The regulations require documented policies and procedures for both in-house and outsourced activities, and proof they are being followed.

Regulator’s new role and stringent monitoring of compliance aims to improve protections for members and beneficiaries and apply risk-based principles to the supervision of pension schemes. The associated effects of this may mean pension schemes are placed under greater scrutiny from regulators potentially leading to increased compliance breaches.

Risk Management Function

As detailed in the directive “it is essential that IORPs improve their risk management while taking into account the aim of having an equitable spread of risks and benefits between generations in occupational retirement provision.”

Strengthening schemes’ risk management systems is one of the directives main aims. A key change resulting from IORP II comes in the form of an Own Risk Assessment that will be conducted every 3 years to test the effectiveness of the risk management system. As such, new risk management assessment and processes will need to be put in place including a formal risk management function. This will urge pension schemes to put in place integrated risk management frameworks encompassing all the schemes systems, structure and processes while also taking account of ESG risks.

ESG Investing

The directive sets out that pension scheme investments should be made in accordance with the ‘prudent person’ rule. This requires trustees to consider the nature, scale, and complexity of a pension scheme. Within that rule, pension schemes are permitted to focus on the long-term impact of their investment decisions on the environment, social issues, and corporate governance concerns, also known as ESG factors.

However, consideration of ESG factors is not mandatory under IORP II. While there is a broader ethical focus in the inclusion of the ESG provision in IORP II, it is also concerned with the potential impact on pension scheme values. New obligations in relation to ESG investment may have far reaching implications on the future of pension schemes. Further adaptions of IORP II may introduce prohibition on certain investments.

Outsourcing Arrangements

An area of significance signalled by regulators is around the outsourcing of services for pension schemes. There are now expanded rules on outsourcing arrangements. Newly introduced requirements will include notification to the regulators of outsourced activities and a requirement for schemes to have an outsourcing policy. Outsourcing will be one of the key risks that regulators will expect to be managed well and it will also be an area that comes under the spotlight from the Internal Audit KFH.

Despite this additional scrutiny, we foresee the trend for outsourcing increasing as trustees and employers look to mitigate the additional risks of the new regulations. For DC schemes, particularly where members will be affected by rising costs, there are other alternatives. These include outsourced single and master trust solutions. These solutions are already available and can help trustees and sponsoring employers to address the regulatory needs flowing from IORP II in a cost-effective way, while still supporting better outcomes for members.

More insights to follow as we focus our attention to Ireland’s implementation of IORP II and identify the next steps for organisations to prepare for the most significant changes to OPS in at least a generation.

Share this article:

Parva Consulting recognized as one of the TOP 20 Best Companies for Generation Z

The Corporate Sustainability Reporting Directive (CSRD) In Focus

https://parvaconsulting.com/wp-content/uploads/2024/06/New-office-in-Switzerland.jpg

450

900

Parva Consulting

https://parvaconsulting.com/wp-content/uploads/2018/04/Parva_logoBianco-266x150.png

Parva Consulting2024-06-10 07:45:012024-06-10 08:44:52Parva Consulting opens office in Switzerland

https://parvaconsulting.com/wp-content/uploads/2024/06/New-office-in-Switzerland.jpg

450

900

Parva Consulting

https://parvaconsulting.com/wp-content/uploads/2018/04/Parva_logoBianco-266x150.png

Parva Consulting2024-06-10 07:45:012024-06-10 08:44:52Parva Consulting opens office in Switzerland