Towards AIFMD II: public consultation and regulatory changes

by Alessandro Li Puma and Federico Lusian

AIFMD II legal framework: where did we start from?

The fundamental goal of AIFMD I (Alternative Investment Fund Managers Directive) in 2011 was establish a harmonised framework regarding the authorisation, management and transparency of all AIFMs. The directive also led to the creation of a single market for Alternative Investment Funds (AIFs) and to the constitution of a common regulation about risk management systems.

In 2020 the European Commission launched a public consultation for the amendment of the directive with the aim of clarifying some existing rules and inserting new ones to solve some critical issues identified after the application of AIFMD I.

Public consultation: who participated and what emerged?

The public consultation was open to all stakeholders, but the largest contribution came from the trade associations of the various European countries. The common view of the associations was that AIFMD I had a positive impact on the regulation of fund managers and on the alternative funds market itself. However, although some associations were against the reform, most of them felt that some critical issues needed to be addressed:

- the rules on the delegation of business functions by AIFMs were discretionary and needed to be better clarified;

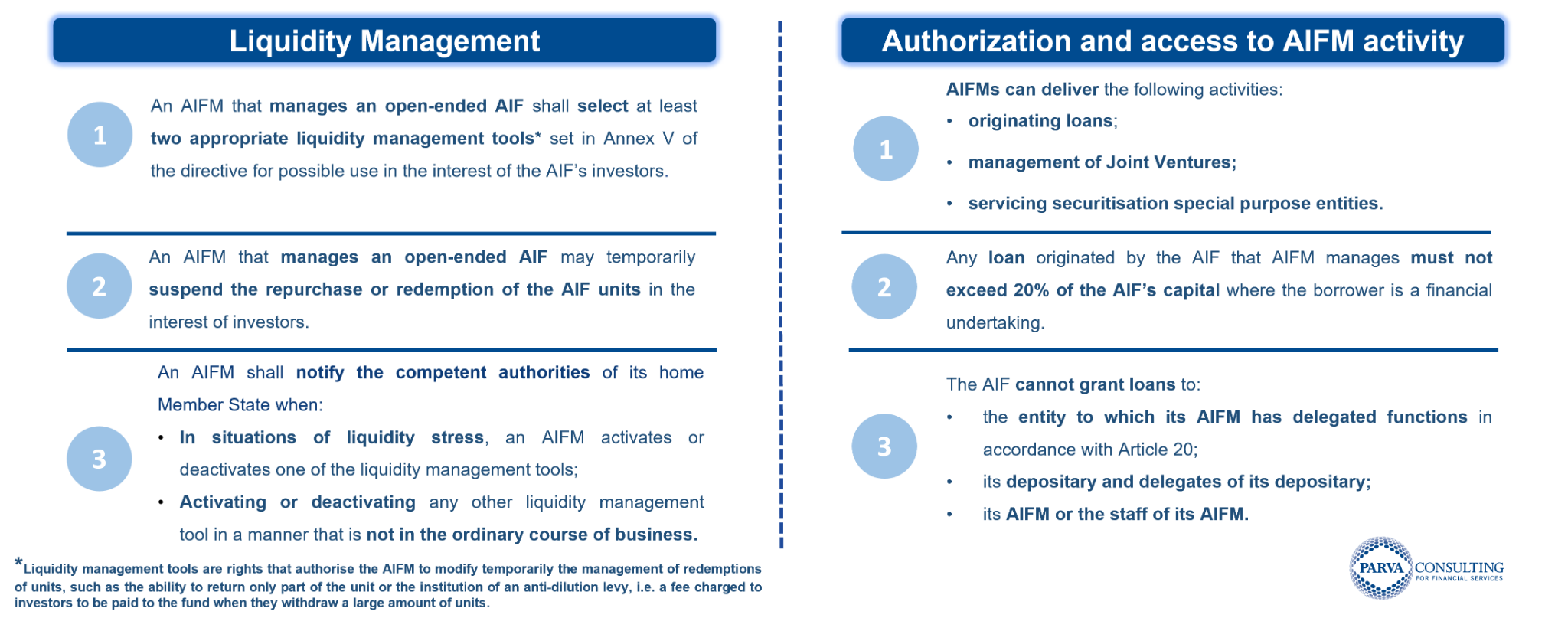

- the rules on liquidity risk management needed to be improved;

- AIFMs must be capable of performing additional subsidiary functions.

We can summarise the associations’ proposals for amending the directive as follows:

- Introduce a “semi-professional” investor category, to allow high net worth individuals (HNWI) to engage in the AIFs market;

- Streamline data collection and update reporting regimes;

- Improve the identification of systemic risks;

- Manage redemption requests efficiently even in a stressed market condition;

- Clarify and extend the regulations concerning the delegation of corporate functions by AIFMs;

- Protect investors from undue costs and misleading information;

- Realise convergence between the UCITS and AIFMD regulatory regimes.

Some associations, including ALFI (Association of the Luxembourg Fund Industry), were openly opposed to the amendment of the directive, considering it unnecessary. This was because, in the associations’ opinion, the rules contained in the AIFMD I on delegation and transparency were already effective; furthermore, those associations believed that instead of introducing a “semi-professional” investor category, it would be sufficient to lower the MIFID’s requirements for access to the professional category.

What changes could the AIFMD II bring?

After analysing the opinions issued by participants to the public consultation, the European institutions decided to focus the reform on the most relevant issues, i.e. those related to delegation, risk identification and investor protection, while postponing the other proposals to future discussions. Although the text of the reform could be further amended, the latest version published by the European Parliament includes the following changes to the legislation:

- Allow AIFMs to offer credit service and other ancillary services in managing the AIF;

- Set the lending limit to financial entities at 20% of AIF’s capital;

- Prohibit lending operations by the AIF to its delegate, to its depositary and to its AIFM;

- Provide the possibility for an AIFM managing open-ended AIF to have more freedom in managing redemption of units to investors in times of market stress in order to safeguard investors’ interest;

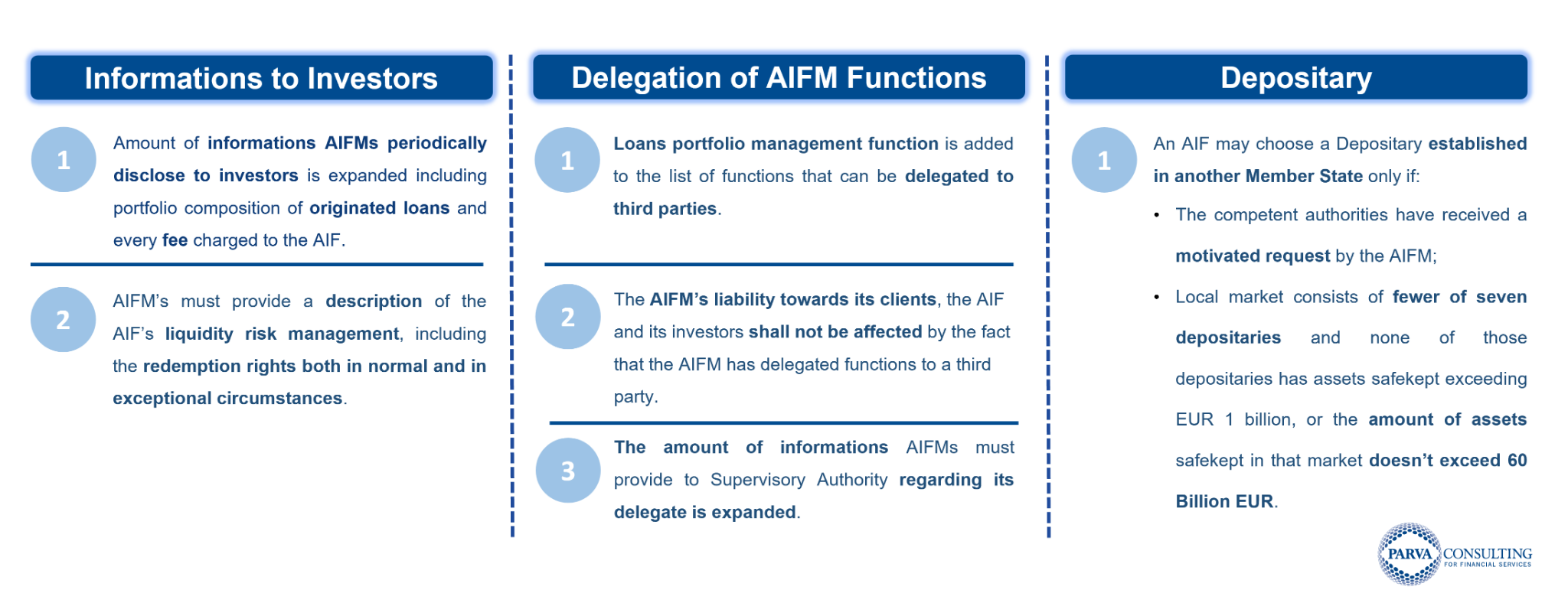

- Expand the amount of information an AIFM has to send periodically to investors, adding the composition of loans portfolio and redemption policies under both normal and exceptional circumstances;

- Expand the amount of information an AIFM has to report to the national supervisory authority about the legal entity to which has delegated certain functions;

- Allow AIFMs to appoint a foreign depositary if there’s a motivated request and the local market consists of fewer of seven depositaries.

Conclusion

Now that the public consultation has been concluded and the revised AIFMD II text has been published, there’s a clearer view of key topics and priorities the regulation will tackle. Nevertheless, the text may be further amended before its final version: so, stay tuned! We’ll monitor the progress and more updates will follow in the forthcoming months.

Share this article:

Evolution of fintech lending

Case Study – Digital transformation project for an international Loan & Leasing company

DORA and contractual arrangements

RAIF and Luxembourg market

Click here to add your own text